To see this formula in practice, let's say you're purchasing a $200,000 home with a 30-year loan and putting down 20 percent. This is the number of years of your loan multiplied by 12.

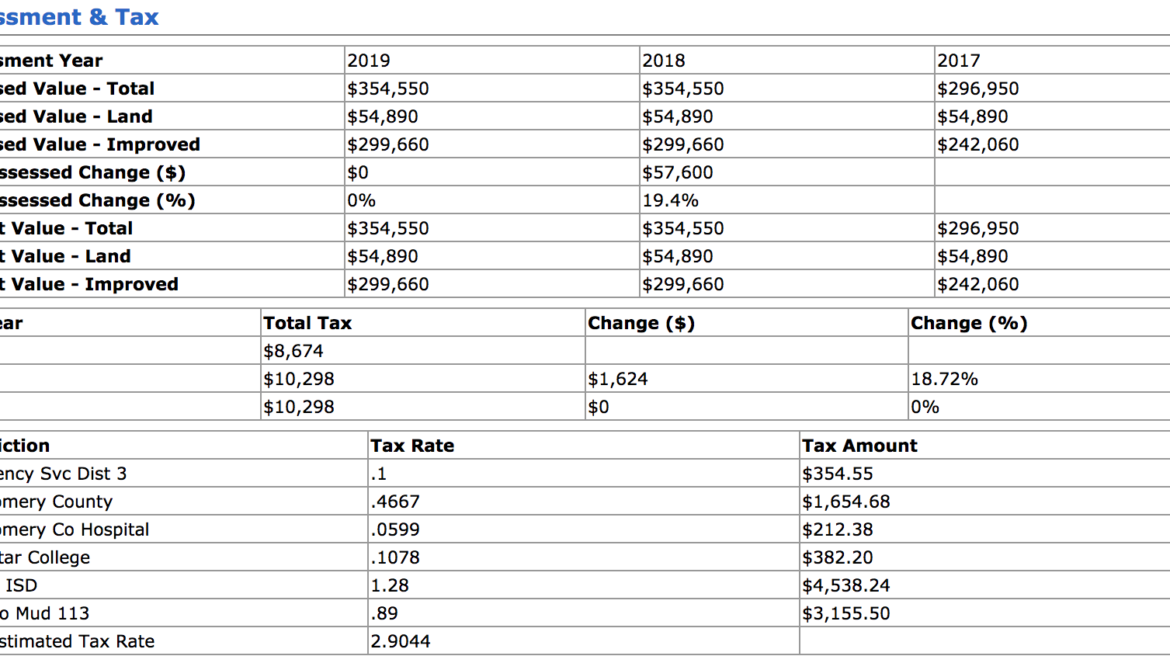

Use the prepayment section to discover how prepaying will affect what you pay in interest over the life of the loan. Run different scenarios with various mortgage amounts and terms to see how it will impact your monthly payment.Sites like also offer the ability to estimate the cost of homeowners insurance based on different variables. These rates vary by structure and location, but your mortgage lender or real estate agent can provide an estimate of how much you'll pay annually. Include your estimated annual homeowners insurance.Your lender or real estate agent can also provide this information. An estimate of annual property taxes is often included along with the listing of a property, but this info can also typically be found on the property tax assessor's website of the county in which the home is located. Input your estimated annual property taxes.The rate you receive depends on a number of factors, including your credit score, down payment, property location and more. Keep in mind that rates fluctuate frequently.

Base the rate off of current mortgage interest rates. Generally, increasing the length of the mortgage repayment period will decrease your monthly mortgage payment but increase your interest payments. While the most common terms are 15 and 30 years, it's possible to get a mortgage of other lengths. Otherwise, put in an amount that reflects the range of home prices in the area where you're looking to buy. If you have a particular home in mind, use that price as your basis. For example, let's say you're considering purchasing a $250,000 home and putting 20 percent down. This is the cost of the home minus the down payment.

Texas mortgage calculator how to#

Our guide also includes resources that help you make smarter decisions in your home-buying journey, instructions on how to use the calculator, and tips for decreasing the amount you pay per month for a mortgage in Texas.How much should you contribute to your 401(k)? Our calculator allows you to adjust the down payment, loan term, interest rate and input additional fees. Using MoneyGeek’s Texas mortgage calculator, you can determine how much it costs to buy a house with all fees included. The average cost of homeowners insurance in Texas is $3,390, and HOA dues vary based on your location.

Nonetheless, monthly mortgage payments in Texas are around $22 cheaper compared to the national average.Īt 1.80%, Texas has the 7th most expensive property tax rate in the United States the average cost per year for property taxes is $3,907. You must account for real estate taxes, insurance premiums and homeowners association (HOA) fees, when applicable, in your budget. If you want to buy a home in Texas, you should know that there are fees on top of the loan’s principal and interest payment.

0 kommentar(er)

0 kommentar(er)